|

|

|

||||||

|

|||||||

Strategic InvestingA Service of Adrich Corporation |

|||||||

|

Strategic Investing focuses on stocks with increasing revenues and profits.

KISS + SF!™ |

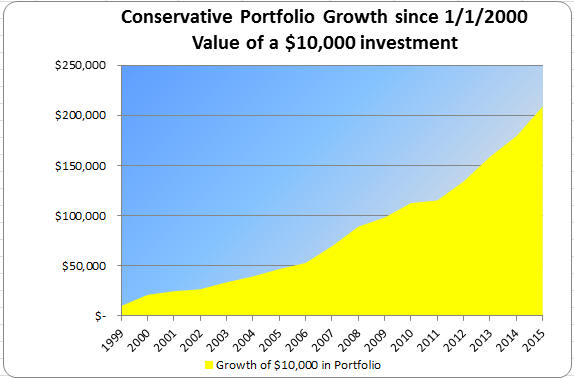

Historical Portfolio PerformanceThe following chart shows the growth of a $10,000 investment in the Conservative portfolio since its inception in May 1996. An investment of $10,000 on January 1st, 2001 would be worth over $208,000 as of December 31, 2015. The Conservative portfolio invests only in stocks which meet the Strategic Investing Conservative Portfolio filters. It never uses margin and often maintains a 100% cash position. Safety of principal is more important that growth in the Conservative portfolio.

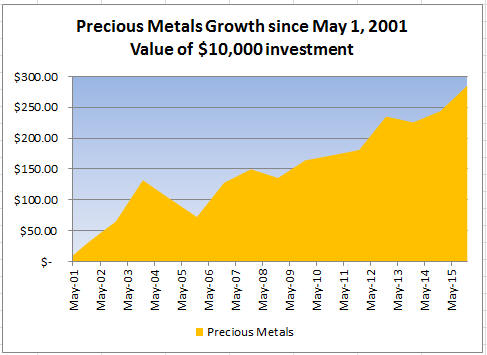

In May 2001, we began our Precious Metals or Gold Portfolio. At its peak, the Precious Metals portfolio had risen almost 13 times in the first two years. During 2004 and 2005, the precious metals shares were in a consolidation phase and the Portfolio dropped in price. A $10,000 investment in this portfolio on May 1, 2001 would now be worth over $285,000. This portfolio has out-performed over the period since May 2001, both the XAU and HUI indices.

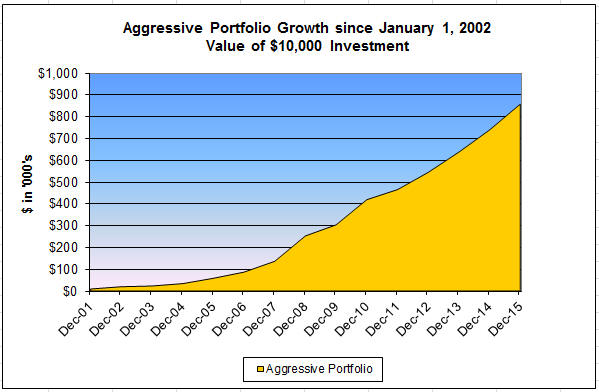

In May 2002, we started our Aggressive Portfolio. The difference between the Conservative and Aggressive portfolio is that we can go both long and short in the Aggressive portfolio and use margin to leverage our positions. The performance of the Aggressive portfolio has been outstanding since its inception except during 2003 when we were pre-occupied with family health problems. Since May 2002, a $10,000 investment in this portfolio would have grown to over $858,000 by December 2015.

All rights reserved © 2001 - 2025 Adrich Corporation Last updated - December 31, 2015 |